As global demand for electric vehicles and renewable energy storage continues to soar, the race to control battery supply chains is heating up. Australia, already rich in lithium and other critical minerals, is positioning itself not just as a raw materials exporter—but as a global battery manufacturing powerhouse.

In this article, we explore whether Australia can truly become a battery superpower, and what industry leaders say about our strengths, challenges, and global competitiveness.

Table of Contents

- Why Batteries Matter to Australia’s Future

- Australia’s Competitive Edge in Raw Materials

- From Mining to Manufacturing: Closing the Loop

- Industry Voices: What the Experts Say

- Infrastructure, Innovation and Investment

- Global Demand and Trade Opportunities

- FAQs

- Conclusion

1. Why Batteries Matter to Australia’s Future

Battery production is at the heart of clean energy, EVs, and energy storage systems. With the global battery market expected to exceed $400 billion by 2035, becoming a player in this industry offers Australia immense economic, environmental, and strategic value.

2. Australia’s Competitive Edge in Raw Materials

- Holds over 50% of the world’s lithium production

- Rich reserves of nickel, cobalt, graphite, and rare earths

- Strong environmental and regulatory standards

This abundance gives Australia a secure, ethical base to develop upstream and downstream battery value chains.

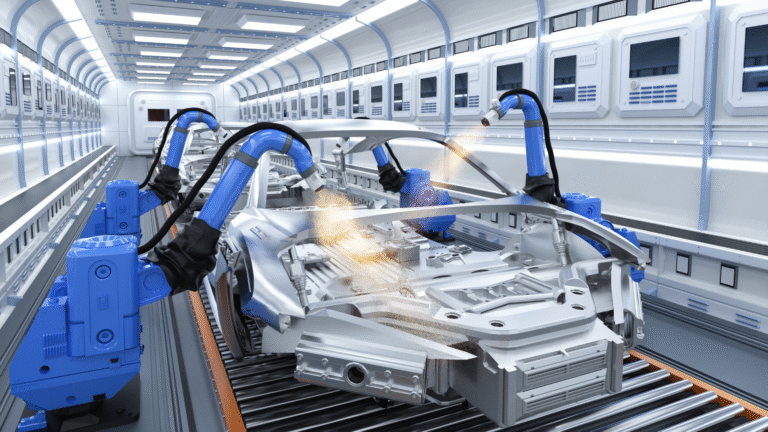

3. From Mining to Manufacturing: Closing the Loop

While Australia excels at extraction, most raw materials are currently shipped overseas for processing and cell production. To become a superpower, local capacity must expand into:

- Cathode and anode production

- Cell and pack assembly

- Battery recycling and reuse systems

Several state and federal programs are now funding facilities to keep more value-added manufacturing onshore.

4. Industry Voices: What the Experts Say

Industry leaders agree Australia has a rare opportunity:

- Supply Chain Stability: Experts highlight the importance of shortening global supply chains and reducing reliance on overseas processing.

- Skilled Workforce: Education institutions and TAFE programs are developing battery-specific training pathways.

- Technology Leadership: Innovators are working on next-gen battery chemistries and AI-driven battery management systems.

The consensus: with the right policy and investment, Australia could lead the southern hemisphere’s battery economy.

5. Infrastructure, Innovation and Investment

Key developments include:

- Dedicated battery precincts in Queensland, WA and SA

- Startup growth in advanced battery systems and fast-charging tech

- International joint ventures seeking to set up Australian gigafactories

Investment is increasing, but experts warn that sustained support is essential to scale up fast enough to compete globally.

6. Global Demand and Trade Opportunities

As nations seek clean energy independence, Australia can play a pivotal role in:

- Supplying ethical battery materials

- Exporting advanced battery technologies

- Supporting EV and grid storage markets in the Indo-Pacific region

The opportunity exists not only to power local demand but to become a critical supplier to allies and trade partners.

7. FAQs

🔋 What’s holding Australia back from battery leadership?

Insufficient downstream manufacturing capacity and global competition from large-scale producers.

🌍 Can Australia export finished batteries?

Yes, especially to Southeast Asia and Europe—if production capacity increases.

💰 Are there incentives to build battery plants locally?

Yes, through federal initiatives, green investment funds, and state-based industrial zones.

8. Conclusion

Australia’s battery future is no longer just potential—it’s in progress. With unmatched resources, growing policy support, and a wave of clean-tech innovation, the nation is poised to go beyond mining and emerge as a full-spectrum battery leader. But success depends on long-term strategy, investment, and execution.

Can Australia become a global battery superpower? Explore insights from industry leaders, the nation’s resource edge, and where manufacturing and innovation stand in 2025.